Account Scheme

The system will automatically create the default accounts. Keeping these accounts as suspense accounts – where all ambiguous transactions are recorded – is recommended.

Account types:

Sales: All sales including tax, and with discounts deducted are recorded on this account (Sales: Credit, Reimburesements: Debit).

Payments: All payments received are recorded on this account (Sales: Credit, Reimbursements: Debit).

Roundings: All roundings related to cash payments are recorded on this account.

Money In: All payments received which have been made without sales (such as cash float) are recorded on this account.

Money Out: All payments which have been made without sales (such as cash float) are recorded on this account.

The following default accounts are not created automatically, so you need to create them if you want to have separate accounts for discounts and taxes from sales:

Discounts: All discounts will be recorded to this account, if you want them to be separate (Discounts: Debit, Discount Reimbursements: Credit)

Taxes: If a separate taxes account has been defined, the Sales account does not contain taxes, which will be recorded on Taxes account instead.

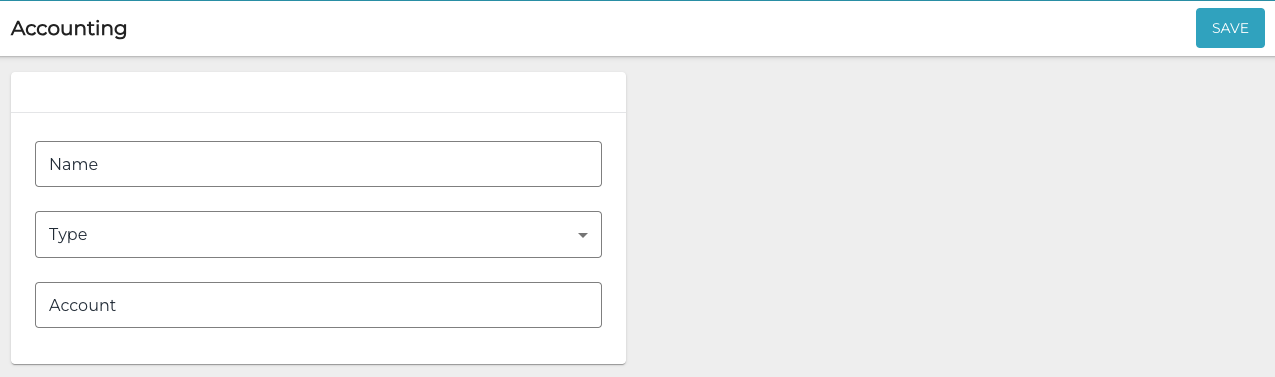

Create a New Account

In the Accounts view, click +Add New.

Enter the following details for the new account:

Name

Type (select from the drop-down menu)

Account identifier

New account

Click Save to save your changed and create the new account.