Accounting for Gift Cards

Create at least one account with VAT 0 in your external accounting system for gift cards. When a gift card is sold, it should be recorded as credit to that account; when a gift card is used, it should be recorded as debit. This way you external accounting system will display the current total value of gift cards that can be used to pay for products.

When a gift card is exchanged for products, the actual VAT is accounted based on the sold product’s VAT.

Accounting for Gift Cards Sold on POS

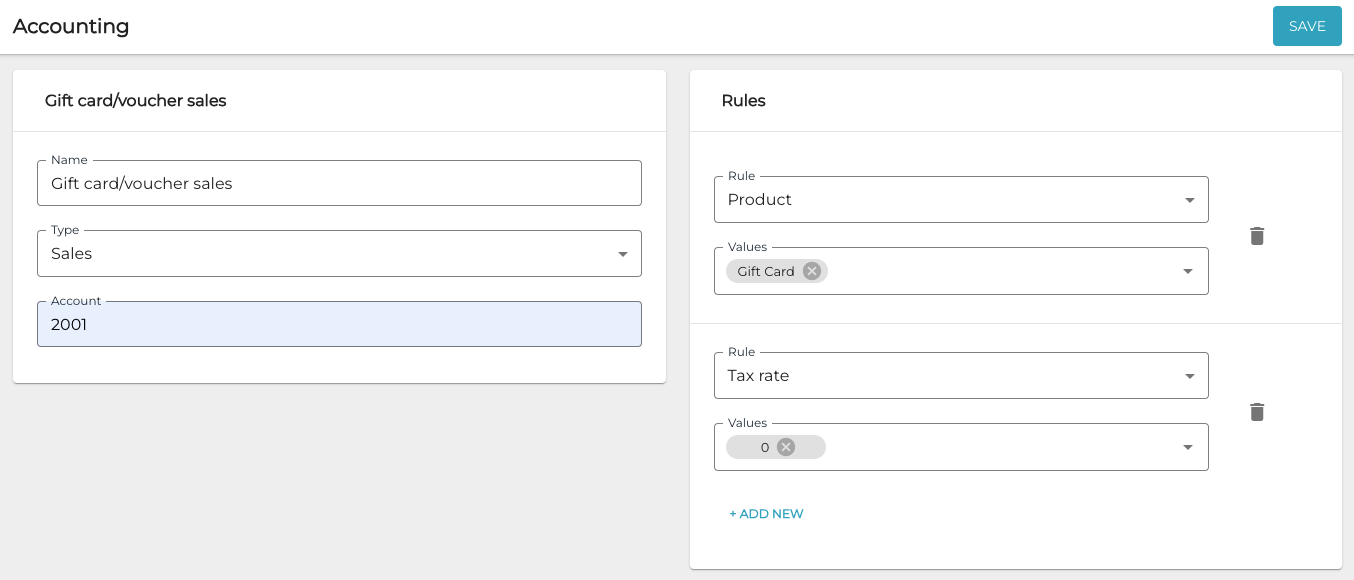

Define a Sales type Accounting rule using the gift card product used on the gift card templates.

You can define multiple rules for different kinds of gift cards (such as vouchers and gift cards).

Add a single gift card product as a value to the rule.

Also add Tax Rate rule with value 0 (this way it is easy to spot and correct errors in cases where a gift card product with VAT 0 has been created by mistake).

Defining the rule for gift card sales

Using Gift Card to Buy Products

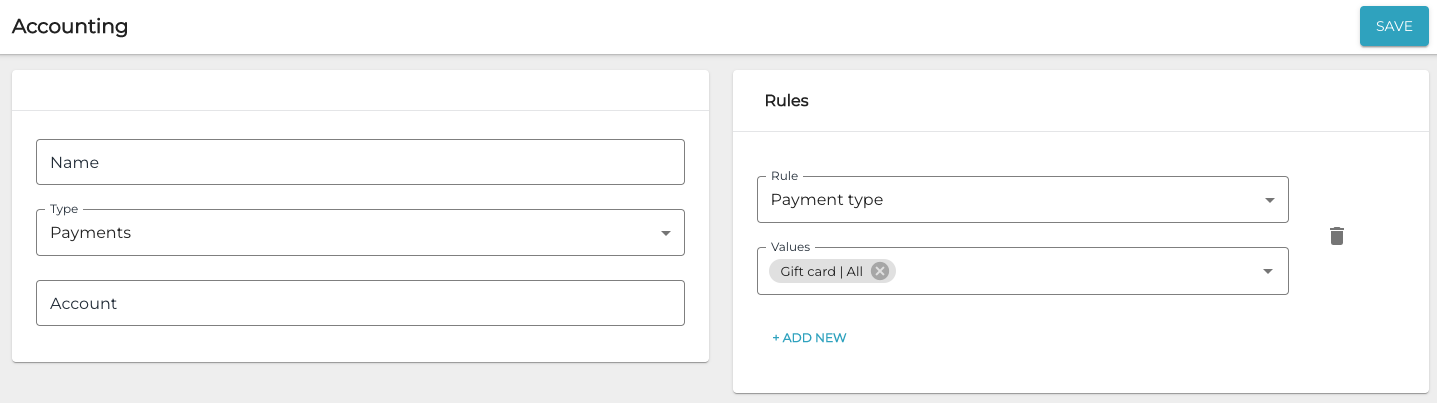

Define a Payment type Accounting Rule with value Gift card ⎮ All for recording the following:

sales of products exchanged for gift cards

the amount of revenue when a gift card has been used as the payment method.

Accounting rule for gift card payments

Expired Gift Cards Clearance

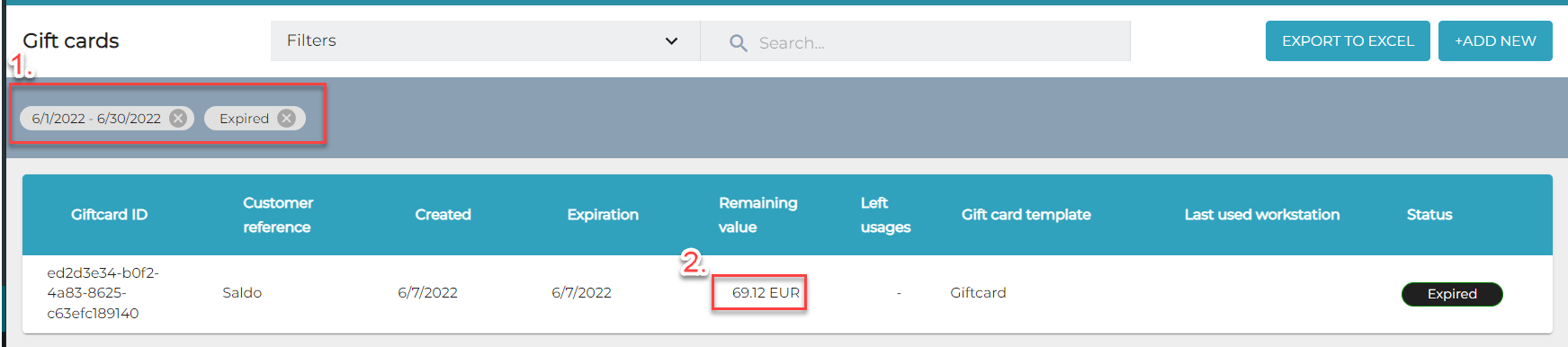

For clearing expired gift cards, first generate a report which contains the expired gift card information; then make a memo transaction manually on external accounting to transfer the unused gift card value to the balance sheet.

To check the expired gift cards for a certain time period in the Gift cards view, use:

a filter with Status: Expired and expiration date (1.), and

remaining value (2.) for clearance.

Expired giftcards report

Creating Gift Cards Manually from the Back Office

These actions will not be included in the accounting report; they need to be manually invoiced and created on the external accounting system.