Accounting

The Accounting module of Solteq Commerce Cloud enables you to create accounts and account rules.

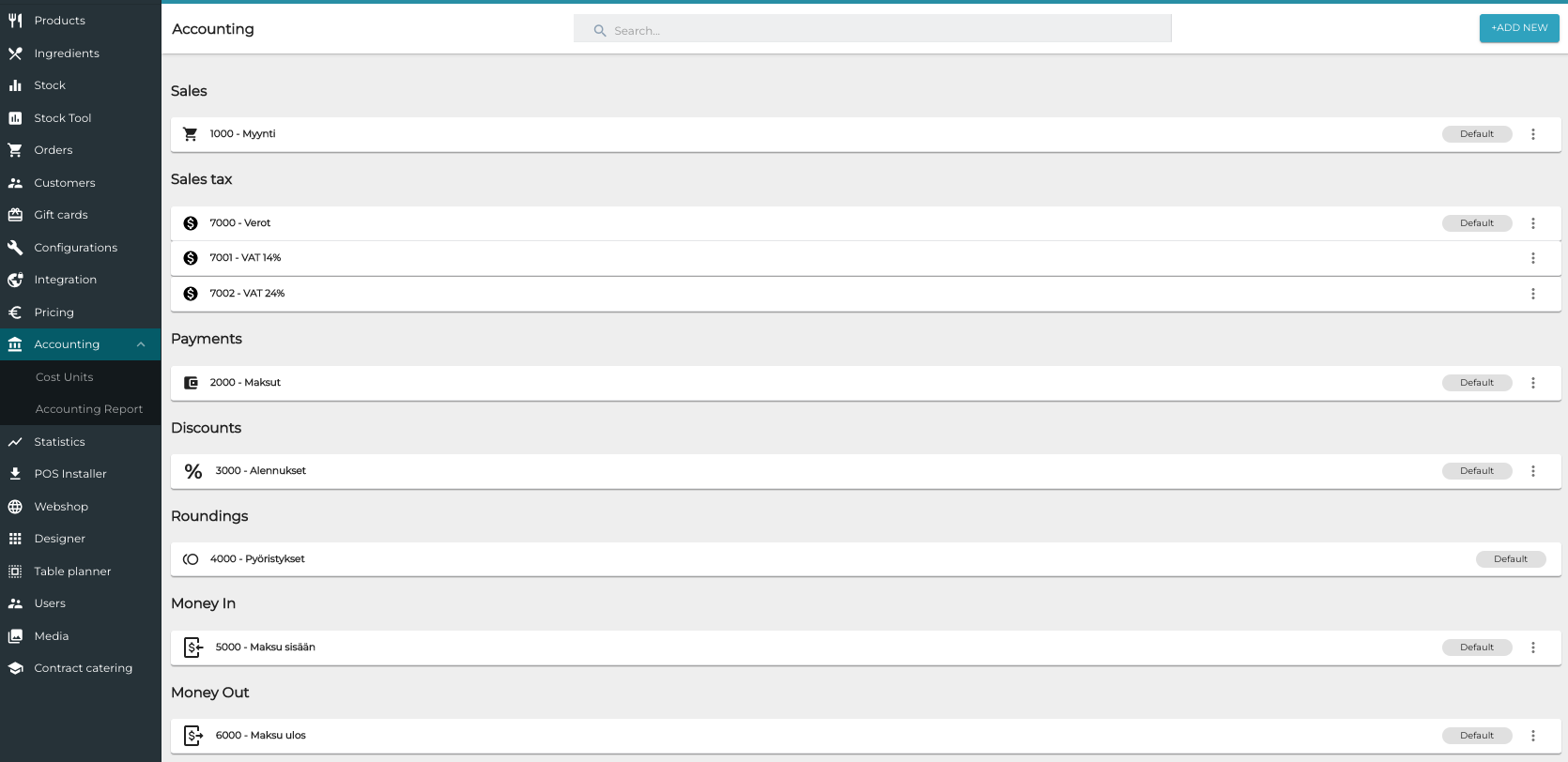

Accounting view in the Back Office

Automatic daily/monthly transfer of transactions to a separate accounting system can also be done with the Solteq Connector integration tool. Supported accounting systems include the following, for example: