Internal Invoicing Rules

Often there is a need to set up internal invoices for handling such cases as:

buying goods for own company in a store

serving refreshments (coffee, snacks and such) for meetings

serving meals in conjunction with a course (lunch is included in the course)

In many cases this also requires special rules for accounting, as no payment is made for the food/services at the restaurant; instead, money is subsequently transferred on accounting systems. Sometimes there is also need to use discounts and/or special products in this context.

To set up internal invoicing, the following things need to be typically configured.

Create Customers and Customer Groups

Usually there is a need to restrict usage of internal invoice only for certain customers and have a cost unit linked to that customer.

Solteq Commerce Cloud does not have a separate view for editing customer group membership (however, it is possible to use Excel Export/Import for this), so create at least one corresponding customer per customer group, and then create a group for that customer:

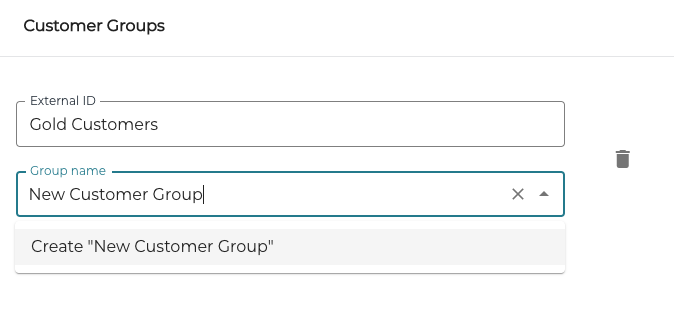

Click Add new group for the customer

Enter External ID and Group name for the new group, and then click Create [name of the new customer group].

Creating a new customer group

Using a CustomerCard identifier for these customers is recommended; customer information is then added automatically to basket when the card it is read in the POS.

Create Payment Method for Internal Invoicing

Add a new payment method in workstation Payment Service settings, with the following information (the most important values only listed):

Type: Internal (Invoice should be left for actual customers, not internal).

Customer needed: True.

Mix Payment not allowed: True (splitting this payment is not needed).

Use max by default: True.

Restrict to selected customer groups: List here all customer groups created per Cost Unit needed.

Overpayment: None (this is always payment for the exact sum).

Custom Field: Usually some free reference is needed. Add one mandatory Reference with type Text.

You need to create this payment method in the Payment Service settings of all the workstations where it is to be used.

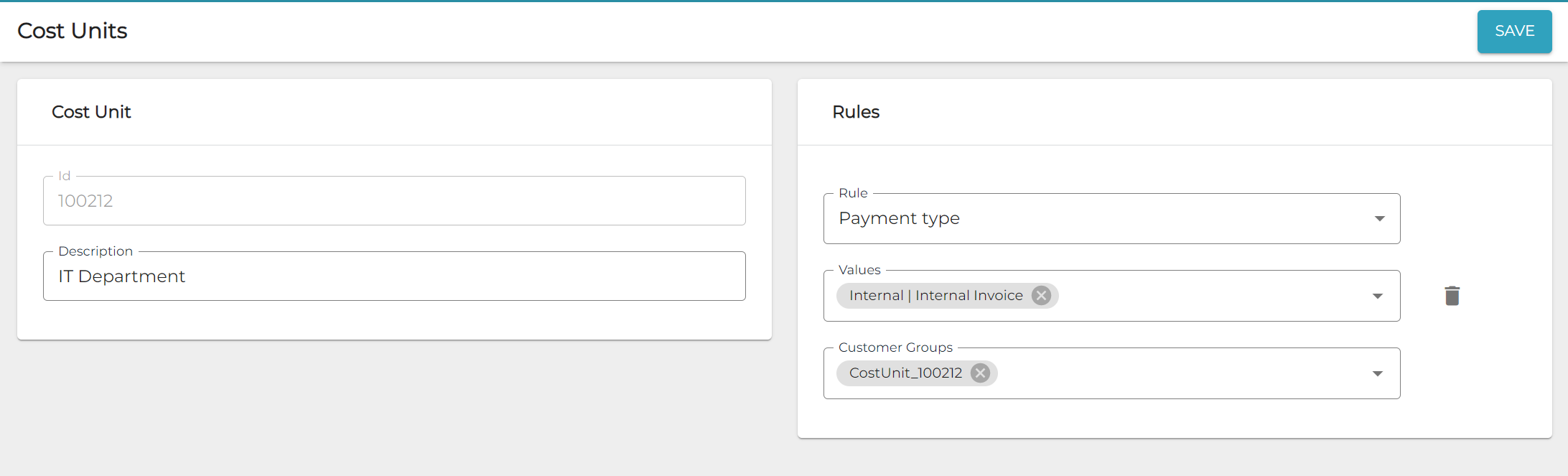

When creating rules for a cost unit, customer group(s) can be defined for a certain payment type or types.

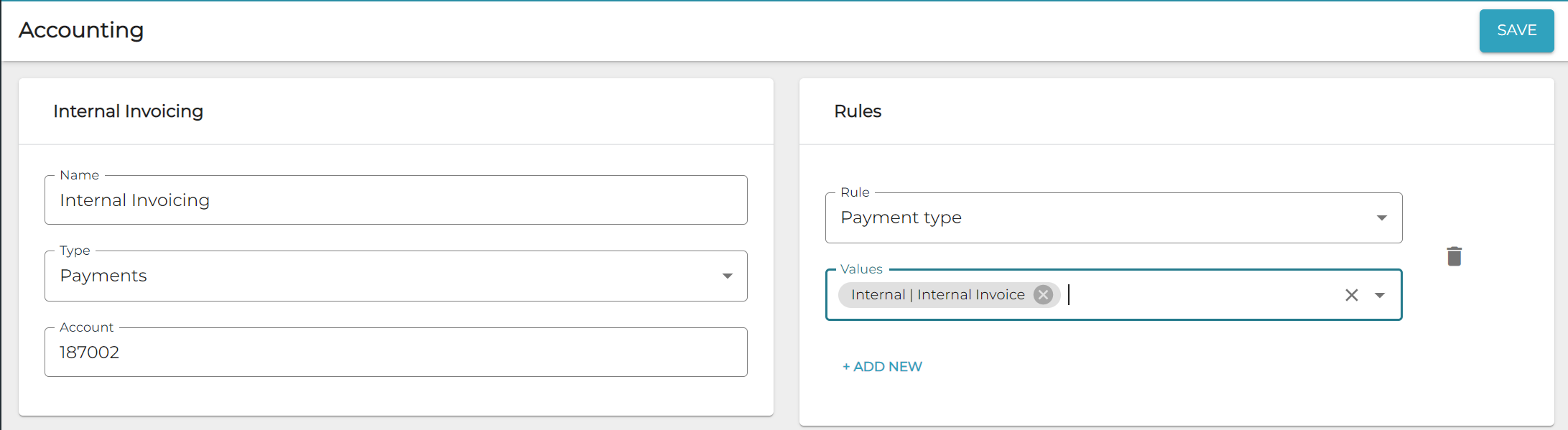

Accounts

Usually there is a special account for internal invoice payments. Sales are transferred to the usual sales accounts.

For payments, add a new accounting rule with Payment type: Internal | Internal Invoice.

New accounting rule for internal invoicing

Cost Units

For Cost Units, create a rule for a cost unit, using the payment method and customer group defined for internal invoicing.

New cost unit rule for internal invoicing

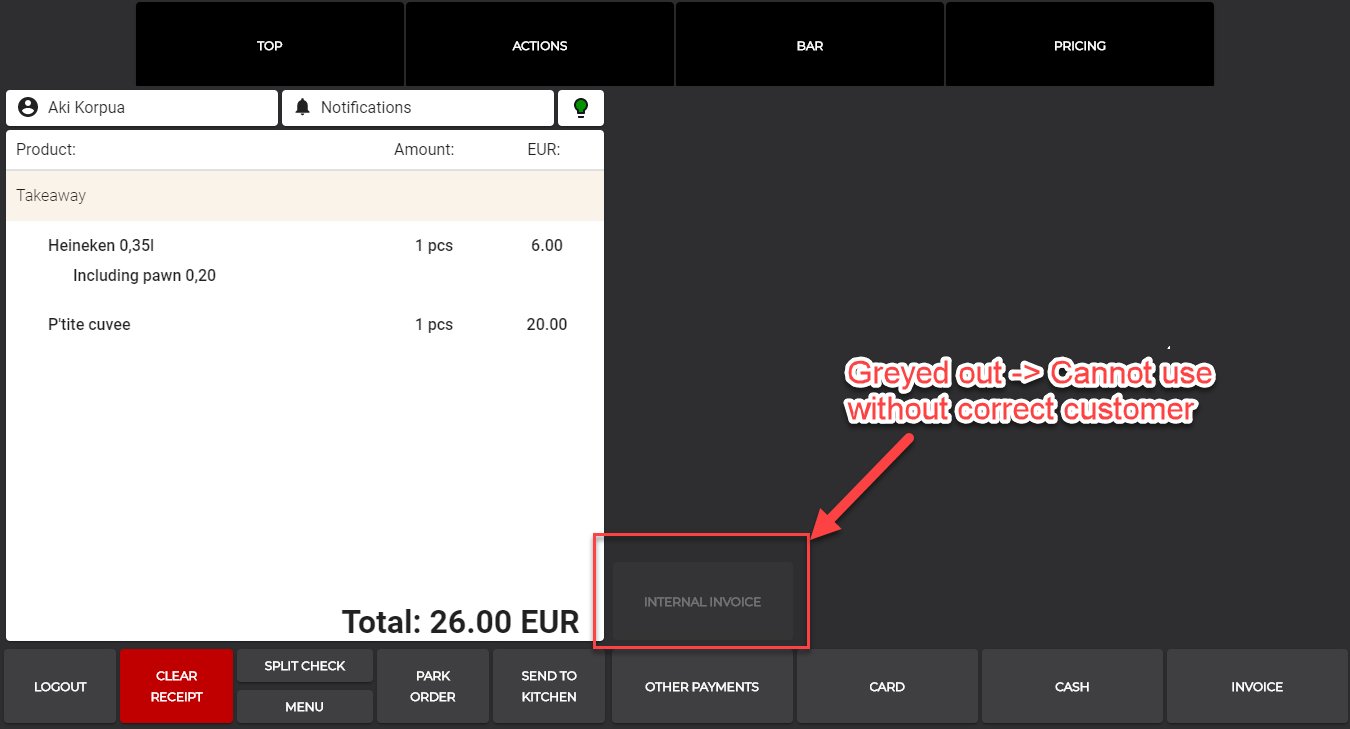

Using the Internal Invoicing Functionality in the POS

In the POS Internal Invoice payment method is available only if you have a customer with correct Customer Group selected.

Internal invoicing in POS

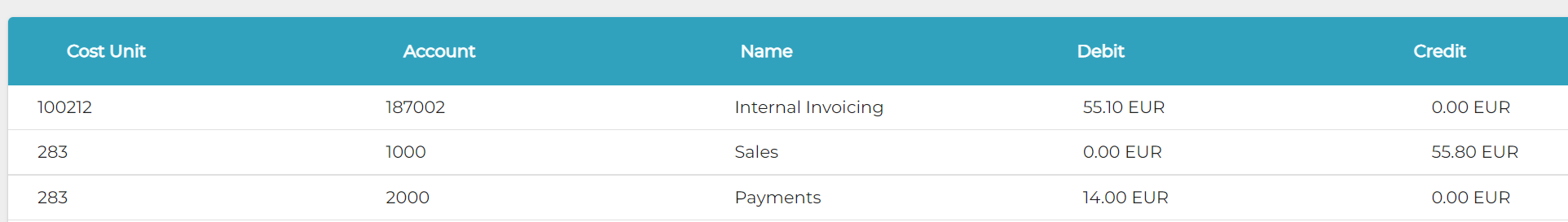

Accounting Report

In the Account reports view, all sales are displayed under the correct accounts and cost unit.

Accounting report with Internal Invoicing row

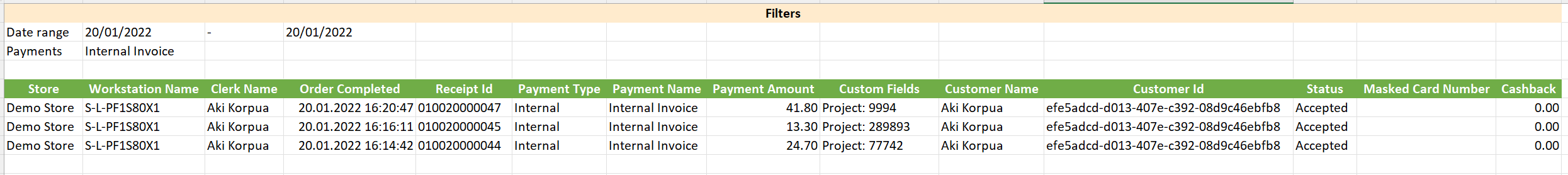

internal invoice rows can also be exported with extensive data from the Orders view, by either using Account or Payment method as the filtering option.

Internal invoice rows in the exported Excel file