Release Notes 12/2025

This release contains the following improvements and fixes:

Corrected the problem which caused customer display settings where Device Type was EscPosLineDisplay to be cleared when the Workstation Configurations of the workstation connected to the customer display were saved. This meant that the parameters were cleared from POS, and the display stopped working.

Corrected the problem which caused gift card PDF files to display the amount in euros, regardless of the main Currency defined in Company Configurations.

For the aforementioned change to take effect, you need to save your Company Configurations once (no need to change the actual settings) after the software update has been done.

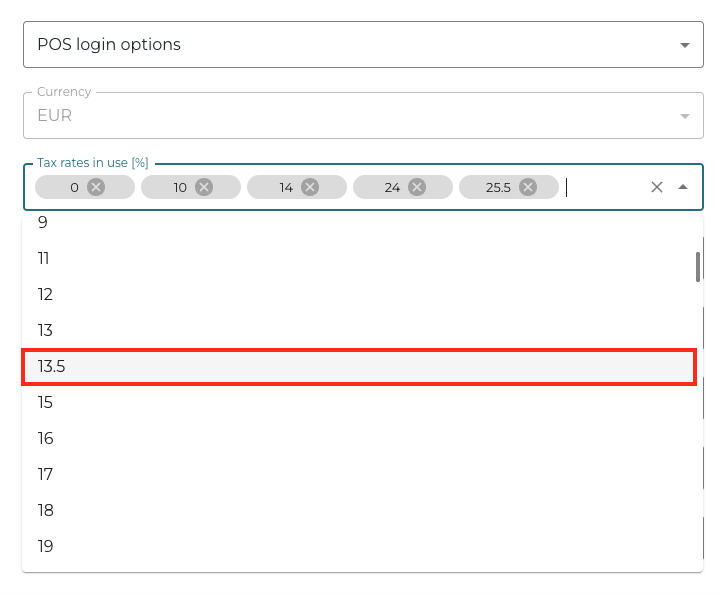

The new Finnish 13,5% VAT rate can now be selected in the Tax rates in use settings in your Company Configurations, and will be visible in the Back Office and POSs once taken into use.

New 13,5% VAT Rate in Tax Rates in Use drop-down menu

Changes have been made to the Transactions functionality to improve system performance:

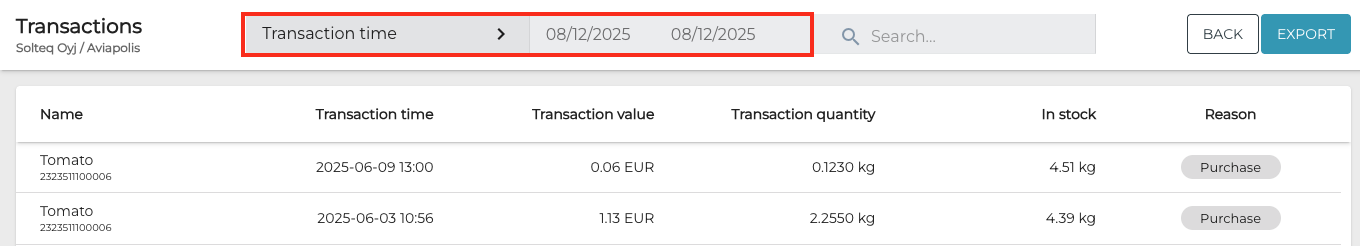

The current calendar day is the default value for the Transaction time filter.

Transaction time filter

Exporting the transactions can be done for a maximum time range of 31 days at a time.

Netvisor API authentication will discontinue using MD5 or SHA265 algorithms, so the Netvisor integration in Solteq Commerce Cloud has been now updated to support authentication using HMACSHA256.

Corrected the following problem: When the Modify company customer contact details if credit allowed setting in User Groups was changed and the changes were saved, subsequently importing customer data in Excel format failed in some circumstances.

When changing the name of a category, the name change will now be applied to

ingredients (in addition to the products/stock items which have the category already assigned to them.

all the aforementioned items with the category assigned to them (not just the first 100 items).

Corrected the following problem: When partially refunding an order that had discount on it, no discount was applied. This resulted in the refund being a bigger sum than the original sum.