Example: Ticket with 10 Uses

In this example we create a multi-ride ticket (gift card) which the customer can buy from POS, and then use it on POS to receive the same product 10 times.

Create a Ticket Product with 10 Uses

First, create a product that can be redeemed on POS with the gift card. Often using a ticket with multiple uses is usually cheaper per use than buying a new single ticket every time.

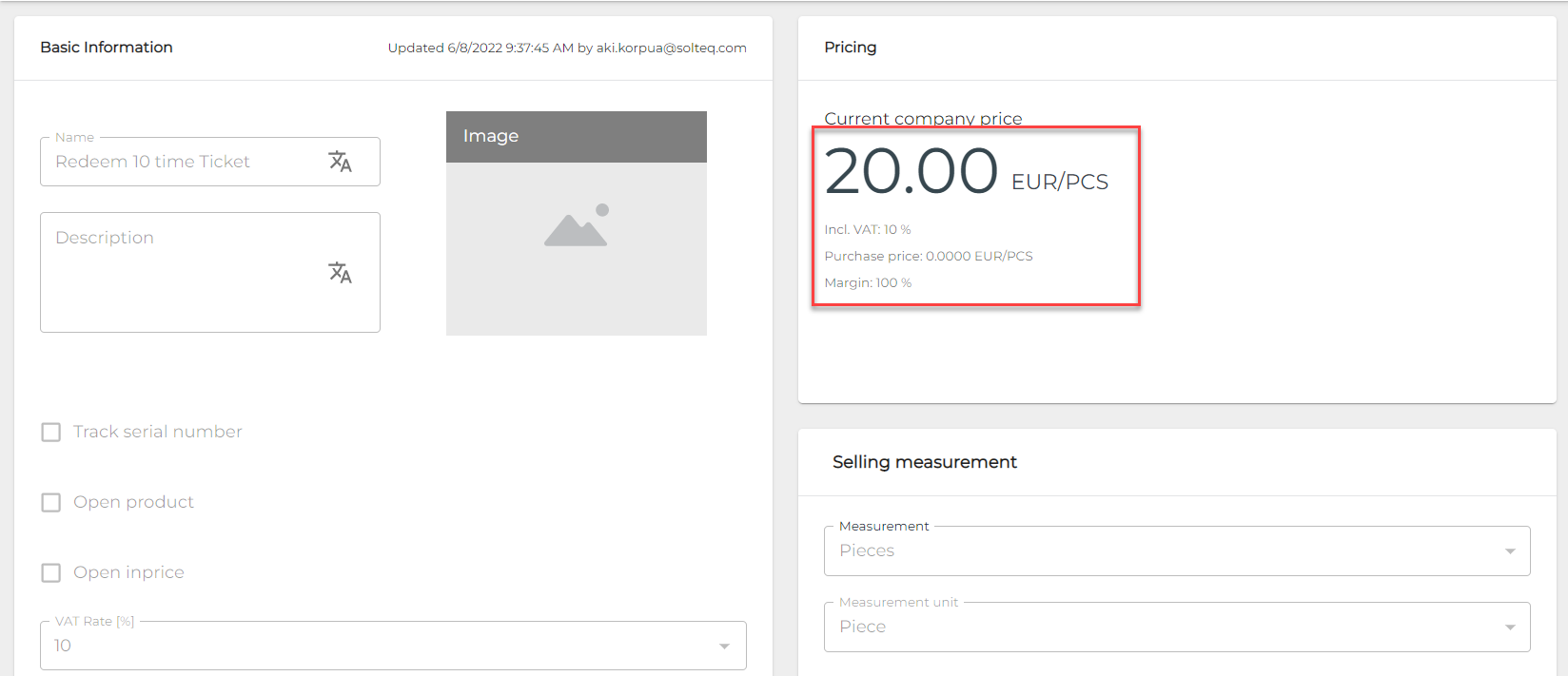

In this example a single ticket costs €25, but with a multi-ride ticket the fare is €20. To make accounting work properly, you should create two products:

Single ticket product with price €25, which can be bought directly from POS

Ticket with 10 uses, which is never sold directly from POS, but is linked to a gift card; every time it is used, the fare is €20.

Product to be linked to the gift card template

Create a Gift Card Template for the Multi-Ride Ticket

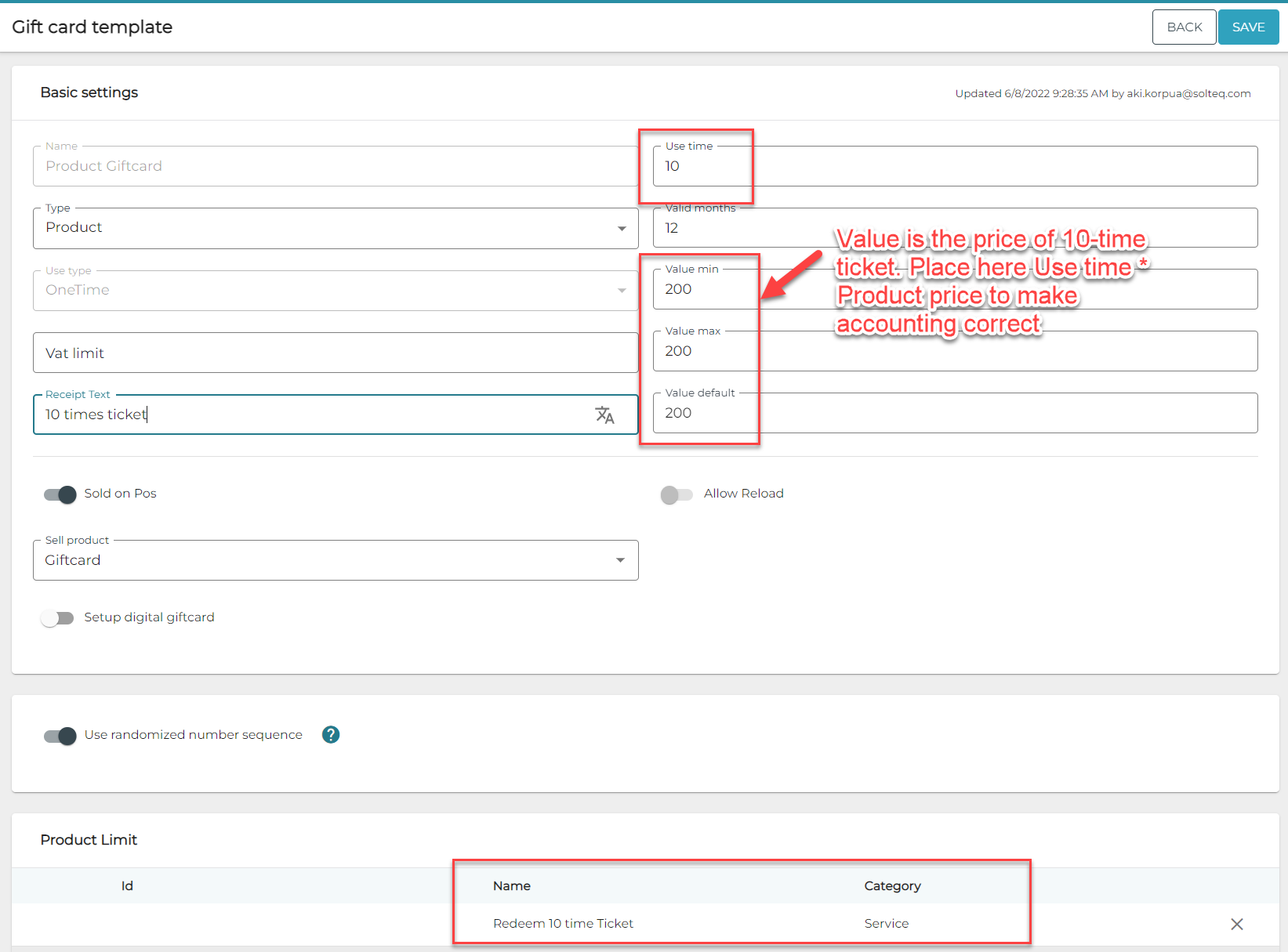

Next, create a Gift Card template with the following options:

Type: Product.

Use time: The amount of times the product can be redeemed.

Value min/max/default: How much a ticket with 10 uses costs on POS. In this example €20 x 10 uses = €200. All of these values should always be exactly the same.

Sold on POS: Enable this option, so the gift card can be sold on POS. Make sure you have created the gift card product with VAT 0%, with the proper accounting rules.

Product Limit: Add here the product the customers can redeem with the gift card with 10 uses.

Gift card template

Selling the Multi-Ride Ticket on POS and Using it on POS

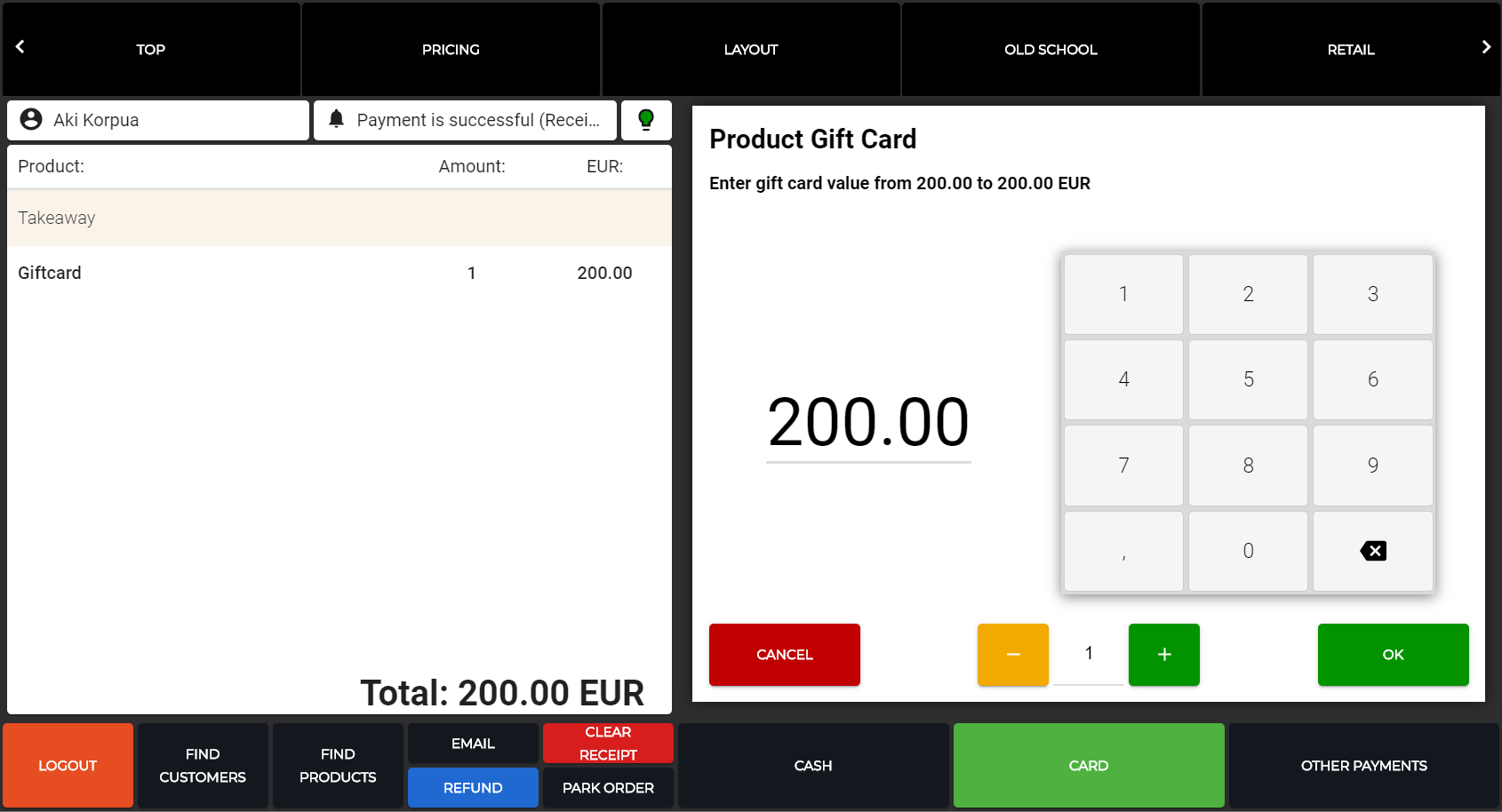

With the settings described above, the multi-ride ticket can be sold on POS by using the Gift Card POS action.

Selling a gift card on POS

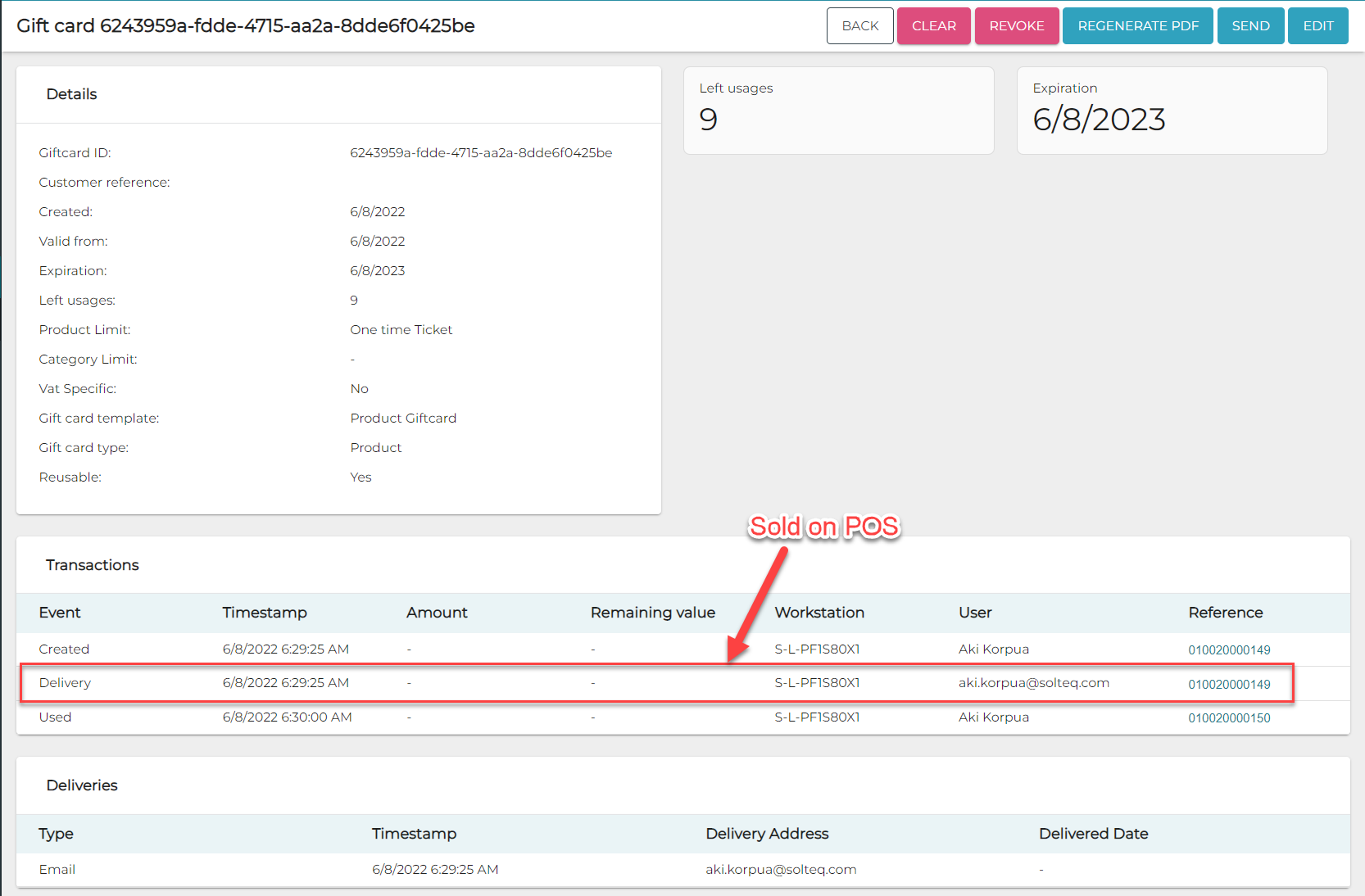

Then, the gift card can be used to redeem the product 10 times. In the Back Office the gift card data is displayed in the following manner after it has been sold and redeemed once.

Gift Card details in the Back Office

Accounting for Multi-Ride Tickets

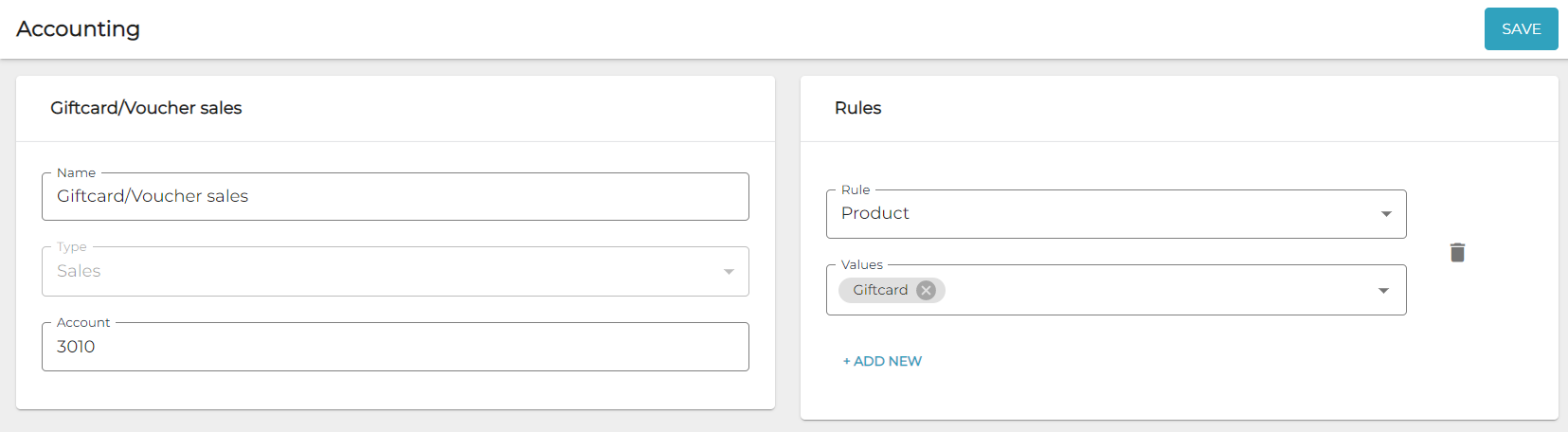

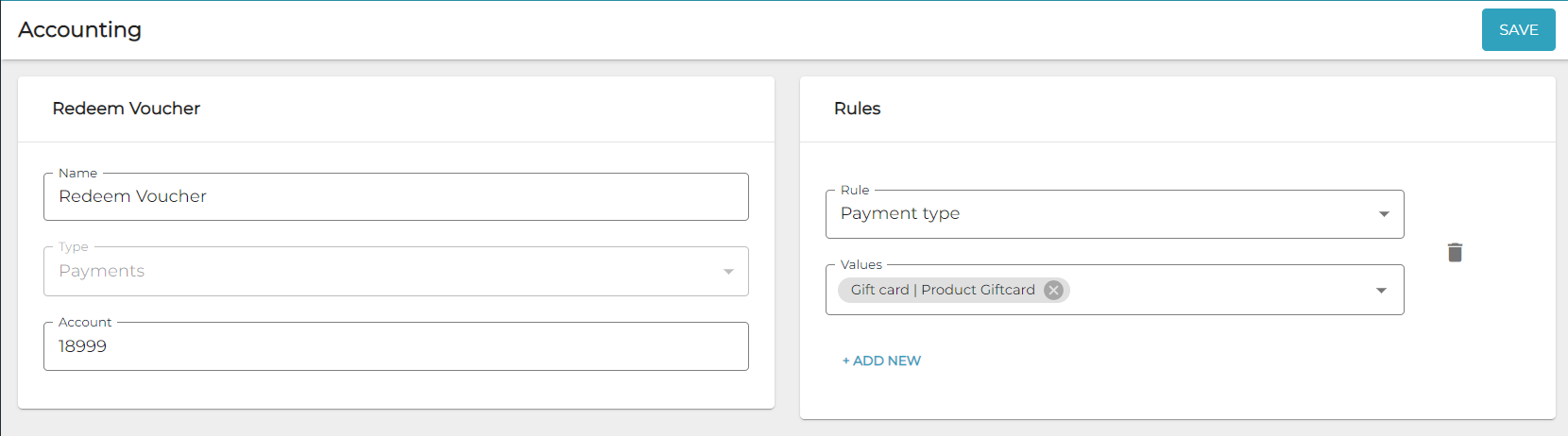

To enable proper accounting of tickets created above, create two additional Accounting rules.

Rule for selling multi-ride tickets

Rule for redeeming the product with multi-ride ticket

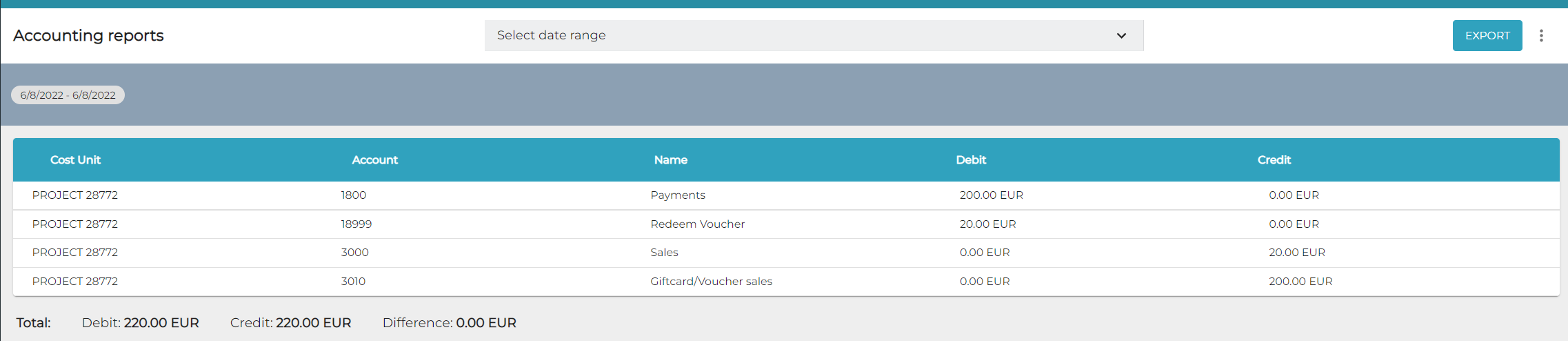

Accounting shows the following information when normal payments are recorded to account 1800, and normal sales to account 3000.

Accounting which displays sales for one the multi-ride ticket, and using it once