Release Notes 08/2023

Generating SAF-T Tax Authority Reports

With this release it is possible to generate Standard Audit File for Tax (SAF-T) compliant reports from the Back Office. SAF-T is an international standard for electronic exchange of reliable accounting data from organizations to a national tax authority or external auditors. The standard is defined by the Organisation for Economic Co-operation and Development (OECD)

SAF-T compliant reports can be created by using Solteq Commerce Cloud’s custom report feature. This change is significant, as it will make it easier to track financial information as well as make better business decisions. You will be able to record company transactions, as well as store records such as user events on POS.

With the optimized recording feature, Solteq can provide your business with the ability to generate customized internal budget/revenue reports with different reporting levels: Company, Store, or User level. The possibility to have advanced cost management reporting and item sales data will allow you to have a detailed overview on events or business days. Using the gathered detailed information, you will be also able to forecast or compare the data with similar day’s data from last year (or any previous year), month, or week.

If you are interested in having custom reports created for your various business needs, please contact our Sales Team or Customer Support.

In order to use this feature, the Solteq Commerce Cloud user needs to belong to a user group which has the Custom Reports: Read and Modify permissions. To add the permissions to a user group:

Click Users and select User groups in the Back Office menu

Select a group by clicking its row in the Users view.

Check the Read and Modify checkboxes on the Custom Reports permission row.

Click Save to save your changes.

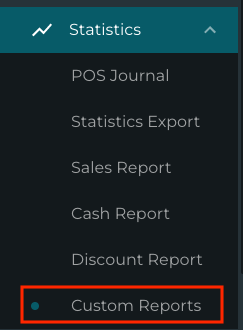

After saving, a new Custom Reports menu item is visible in the Back Office menu under Statistics, as seen below.

Custom Reports in the Back Office menu

Deleting Stock Items

With this release it is possible to delete stock items from the system. This feature is useful in cases where there has been a mistake in creating a stock item, for instance. Deleting a stock item is done by clicking the new Delete icon in the Stock item Details view. The system will ask for confirmation before the stock item is deleted.

Delete icon in the Stock Item Details view

A stock item cannot be deleted straight away if it

belongs to a Stock, and/or

belongs to a transaction order with Pending status

See Deleting Stock Items for more information.

Sorting Options in Stock Insight, Inventory and Transaction Orders

To enhance usability, sorting the information in Stock Insight, as well as in the Products sections of Inventory and Transaction Order details is now possible by using various criteria:

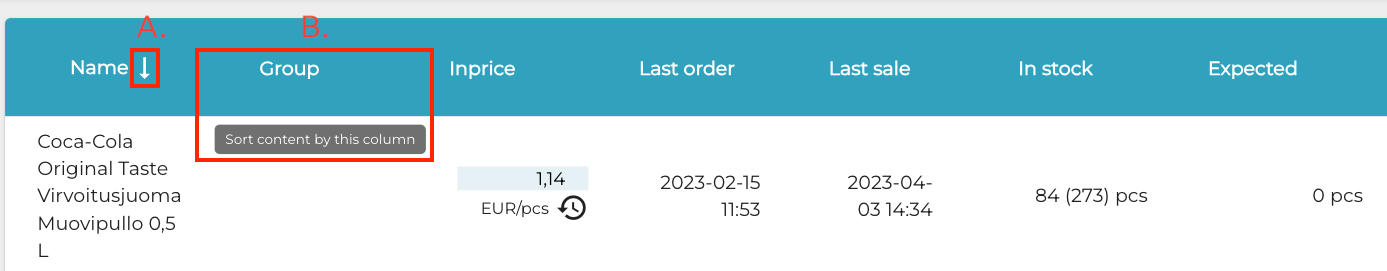

The arrow icon next to the column header (A.) indicates that the column is used as the sorting criteria. Click on the arrow icon to sort the information in either ascending or descending order.

To select another column header to be used as the sorting criteria, click on the column (B.).

Sorting icon and Sort content by this column pop-up hover text

You can use the following sorting options in the various Back Office views:

Stock Insight:

Name

Group

Inprice

Last order

Last sale

In stock

Expected

Inventory:

Name

Group

In stock

Inventory

Difference

Transaction Orders:

Name

Group

Supplier

Purchase price

In stock

Expected quantity

Received quantity

Value

Other Improvements and Fixes

Improvements have been made to the system performance, to handle large order events.

An error in product removal from Transaction Orders has been corrected; the error occurred in

Purchase orders: when a line/product was removed, the order could be completed and the Transaction Total field contents remained empty.

Transfer orders: when a product was removed from the order by clicking X, the line was removed but not its data.

Corrected the problem which occurred when importing stock products in Excel format after importing the corresponding stock items in Excel format: inprices were missing (0) from product information. Now the inprices work, no matter in which sequence the Excel files were imported in.

Corrected the error which made it possible to add an Identifier for a product without selecting the Identifier type.

A font change has been implemented for printing receipts in the V3M2 Poplapay payment terminal interface; this was done to make the text in receipts easier to read. The new font is Roboto Mono Extra Bold, recommended by PoplaPay.

Corrected the problem which caused printing of receipt to fail when the receipt contained discounts and had been parked.