The Upcoming VAT Percentage Change in Finland: General Information & Instructions

The general VAT rate in Finland will rise from 24% to 25,5% from 1 September, 2024. Because of this change, decimals can now be used for VAT rates in Solteq Commerce Cloud. The implemented change will be visible in the Back Office, POS, Mobile POS, and Kiosk.

Solteq will make the update in the system to change VAT 24% to 25,5% for products, ingredients and stock items.

The change will be implemented on September 1, 2024 from approximately 00:00 to 02:00. Any prices will remain unaffected by the change.

If you encounter any problems after the change has been implemented, contact Solteq Customer Service (tel. +358 9 5422 5421, e-mail: asiakastuki@solteq.com).

The new 25,5% VAT rate can be set/selected in the following Back Office functions:

Products (all product types)

Exporting and Editing the Product List (VAT Rate filter and taxpercent field in the Excel file)

Exporting, Importing, and Editing Ingredients in Excel Format (taxpercent field in the Excel file)

Mass Editing/Creating Stock Items with Excel Export/Import (taxpercent field in the Excel file)

Gift Card Templates (Vat Limit field)

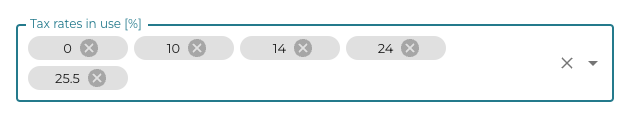

Company Configurations (Tax rates in use settings)

Payment Service (Overpayment tax setting)

Skidata integration (VAT rate [%] setting)

Accounting (Rule types: Sales, Sales tax and Discounts)

Fast Contract Meals application

Instructions for Solteq Commerce Cloud Users

Check the POS Software version; Update if Needed

In order to use the new general VAT rate, the POS software used in your workstations must be updated to the latest version:

POS Service version: 2408.7.1 (pilot) or 2408.12.1 (POS).

POS UI version 2408.12.2.

See here for instructions on how to check and update the version.

Check and Update Your Accounting Rules

If you have created accounting rules which utilize VAT 24% in the Back Office, you need to update the existing rules to use the new 25,5% percentage or create new ones using VAT 25,5%.

Note: Before you can use the new VAT 25,5% in any accounting rules, you need to add the new percentage to the Tax rates in use settings in your Company Configurations.

Tax rates in use in Company Configurations

If you are using accounting integrations with Solteq Commerce Cloud, contact Solteq Customer Support after creating new accounts.

Adjust Product Prices (optional)

If you want to adjust your product prices to reflect the new VAT rate hike, the recommended way for this is the following :

Filter the product list in Products view, using tax rate 25,5% as the criteria (or 24% as the criteria, if you export the products before September 1st, 2024)

Export the filtered product list from the Back Office in Excel format.

Update the product prices in the Excel file.

Import the updated product information in Excel format to the Back Office.

For detailed instructions, see Exporting and Editing the Product List.

It is also possible to plan out new prices by using the Defining New Regular Prices in Advance feature in the Back Office.